Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Use the following information for questions 98 through 100.

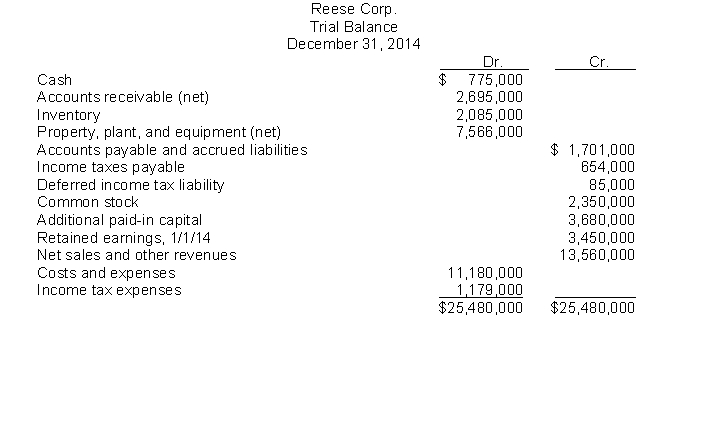

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The current assets total is

Definitions:

Standard Of Living

A measure of the wealth, comfort, material goods, and necessities available to a certain socioeconomic class or geographic area.

Economic Growth

A rise in the economic power to produce goods and services when comparing distinct periods.

Capital Formation

The process of accumulating assets and investments that are used for future production or economic growth.

World Bank

An international monetary organization granting loans and finances to governments of less affluent countries for capital project undertakings.

Q5: Perpetual LIFO.<br>A record of transactions for the

Q45: Earnings per share data are required on

Q49: The account form and the report form

Q53: Anna has $15,000 to invest. She requires

Q58: A measure of a company's financial flexibility

Q71: Verifiability and predictive value are two ingredients

Q91: Financial flexibility is a company's ability to

Q100: Mune Company recorded journal entries for the

Q115: Jane wants to set aside funds to

Q170: If a company purchases merchandise on terms