Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Use the following information for questions 98 through 100.

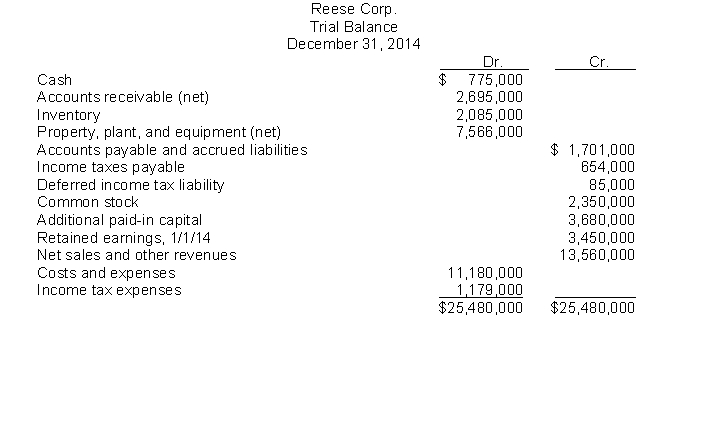

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The current liabilities total is

Definitions:

Presbycusis

Age-related hearing loss, a gradual loss of hearing that occurs as people get older.

Ménière's Disease

A disorder of the inner ear causing vertigo, hearing loss, and tinnitus.

Tinnitus

A condition characterized by hearing noises in the ears (such as ringing, buzzing, or hissing) when there is no external sound source.

Methicillin-Resistant Staphylococcus Aureus

A type of bacterium that is resistant to several antibiotics, originally methicillin, causing infections in different parts of the body.

Q7: Which of these is generally an example

Q26: The financial statement which summarizes operating, investing,

Q41: The double-entry accounting system means<br>A) Each transaction

Q43: The existing conceptual frameworks underlying GAAP and

Q63: The IASB and the FASB are working

Q77: What would you pay for an investment

Q80: An IFRS statement might include all of

Q95: If $5,000 is deposited in a savings

Q99: An effective process of capital allocation promotes

Q129: AG Inc. made a $15,000 sale on