Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Use the following information for questions 98 through 100.

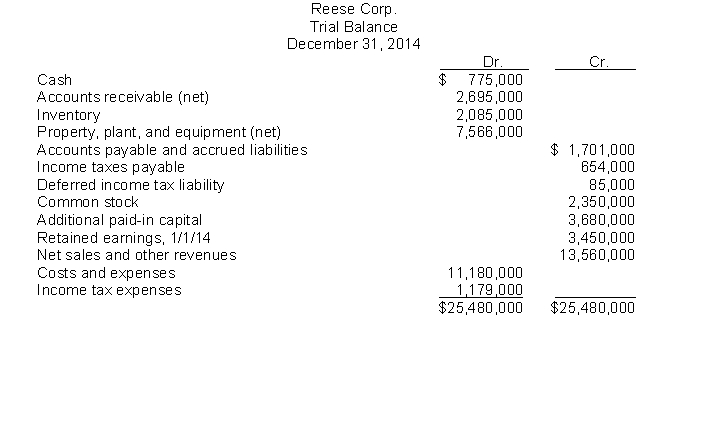

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The final retained earnings balance is

Definitions:

Q7: The statement of cash flows reports all

Q41: A cash equivalent is a short-term, highly

Q50: June Corp. sells one product and uses

Q74: For Mortenson Company, the following information is

Q77: Perry Corp. reports operating expenses in two

Q82: Leonard Corporation reports the following information:Correction of

Q96: Stine Corp.'s trial balance reflected the following

Q107: Financial flexibility measures the ability of an

Q124: A machine is purchased by making payments

Q155: Which of the following is an implication