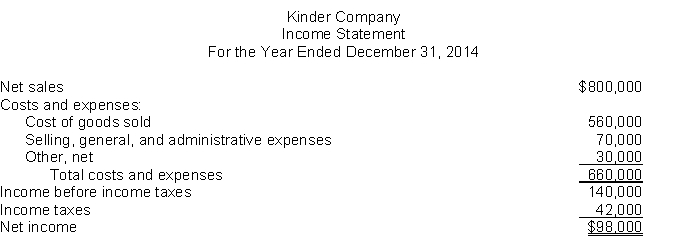

Single-step income statement.Presented below is an income statement for Kinder Company for the year ended December 31, 2014.  Additional information:1. "Selling, general, and administrative expenses" included a usual but infrequent charge of $7,000 due to a loss on the sale of investments.2. "Other, net" consisted of interest expense, $10,000, and an extraordinary loss of $20,000 before taxes due to earthquake damage. If the extraordinary loss had not occurred, income taxes for 2014 would have been $48,000 instead of $42,000."4. Kinder had 20,000 shares of common stock outstanding during 2014.

Additional information:1. "Selling, general, and administrative expenses" included a usual but infrequent charge of $7,000 due to a loss on the sale of investments.2. "Other, net" consisted of interest expense, $10,000, and an extraordinary loss of $20,000 before taxes due to earthquake damage. If the extraordinary loss had not occurred, income taxes for 2014 would have been $48,000 instead of $42,000."4. Kinder had 20,000 shares of common stock outstanding during 2014.

InstructionsUsing the single-step format, prepare a corrected income statement, including the appropriate per share disclosures."

Definitions:

Right to Cancel

A legal entitlement allowing a party to terminate an agreement or contract within a specific time frame.

Promisee Promises

Commitments or assurances made by the promisee (receiver of the promise) within a contractual agreement.

Bankruptcy Reform Act

A piece of legislation that reformed the bankruptcy system, typically referring to the Bankruptcy Reform Act of 1978 or amendments thereof.

Debtors

Individuals or entities that owe money to others.

Q10: The economic entity assumption<br>A) is inapplicable to

Q38: At the end of 2014, Drew Company

Q56: Logan Corp.'s trial balance of income statement

Q69: What is the purpose of a FASB

Q72: The purpose of the International Accounting Standards

Q75: The correct order to present current assets

Q81: The income statement provides investors and creditors

Q93: Which of the following is not an

Q108: Which of the following is the first

Q138: What is meant by comparability when discussing