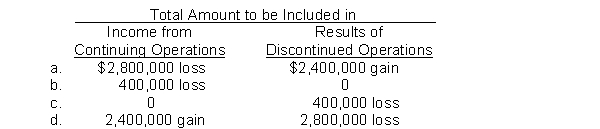

During 2014, Lopez Corporation disposed of Pine Division, a major component of its business. Lopez realized a gain of $2,400,000, net of taxes, on the sale of Pine's assets. Pine's operating losses, net of taxes, were $2,800,000 in 2014. How should these facts be reported in Lopez's income statement for 2014?

Definitions:

Q15: If an annuity due and an ordinary

Q28: An adjusted trial balance that shows equal

Q30: The financial statements most frequently provided include

Q44: Which of the following items represents a

Q47: The body that has the power to

Q51: Not adjusting the amounts reported in the

Q76: On June 1, 2014, Yang Corp. loaned

Q115: The first level of the conceptual framework

Q118: Lawrence Company has cash in bank of

Q124: Which of the following is not a