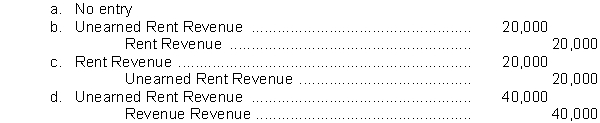

Murphy Company sublet a portion of its warehouse for five years at an annual rental of $60,000, beginning on May 1, 2014. The tenant, Sheri Charter, paid one year's rent in advance, which Murphy recorded as a credit to Unearned Rent Revenue. Murphy reports on a calendar-year basis. The adjustment on December 31, 2014 for Murphy should be

Definitions:

Reliability

The degree to which an assessment tool produces stable and consistent results across multiple measurements.

Validity

The extent to which a test or instrument measures what it is supposed to measure.

Predictive Validity

The extent to which a score on a scale or test predicts future performance on a related outcome.

Culture Bias

The tendency to interpret or judge phenomena by standards inherent to one's own culture, potentially leading to misunderstanding or prejudice.

Q10: Icon International, a software company, incorporated on

Q26: A company receives interest on a $70,000,

Q46: Economists assume that firms maximize:<br>A) the

Q69: What is the purpose of a FASB

Q72: According to the FASB conceptual framework, which

Q94: A generally accepted method of valuation is<br>1.

Q97: In calculating earnings per share, companies deduct

Q98: What would be an advantage of having

Q118: Which of the following is not a

Q120: The basis for classifying assets as current