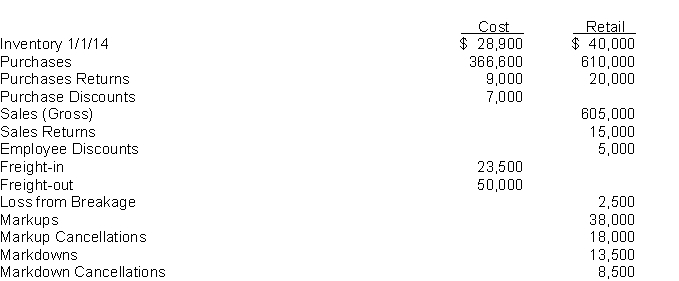

Conventional and LIFO Retail Method.Note to Instructor. Part B is based on Appendix 9-A.A. Landmark Book Store uses the conventional retail method.

InstructionsGiven the following data, prepare a neat, labeled schedule showing the computation of the cost of inventory on hand at 12/31/14.  B. Landmark Book Store has decided to switch to the LIFO retail method for the period beginning 1/1/15.

B. Landmark Book Store has decided to switch to the LIFO retail method for the period beginning 1/1/15.

InstructionsPrepare a schedule showing the computation of the 12/31/15 inventory under the LIFO retail method adjusted for price level changes (i.e., dollar-value LIFO Retail.) Without prejudice to your answer in requirement A above, assume that the 12/31/14 inventory computed under the LIFO Retail method was $40,000 and $27,500 at retail and cost, respectively, for purposes of this requirement. Data for 2015 follows:

Definitions:

Initial Endowment

The initial allocation of income, wealth, or resources that an individual or firm possesses before entering into any economic transactions.

Taxes Rise

Taxes rise refers to the increase in the required contributions by individuals or corporations to government revenues.

Laspeyres Price Index

a measure of the change in the cost of purchasing a fixed basket of goods and services, relative to the cost of the same basket in a base period.

Demand Function

A mathematical expression showing the relationship between the quantity demanded of a good and its price, along with other determinants like income and prices of related goods.

Q11: The current assets section of a balance

Q14: How should unearned discounts, finance charges, and

Q19: Olsen Company paid or collected during 2014

Q54: (Figure 8.4) In a perfectly competitive market

Q60: The FASB's Codification creates a new set

Q66: Trading SecuritiesThe information below relates to Milton

Q67: Answer the following questions. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB3883/.jpg" alt="Answer

Q88: (Figure 5.2) Hamburger meat is a(n) _

Q123: When a revenue is collected and recorded

Q123: The IASB is considering a proposal to