Use the following to answer question:

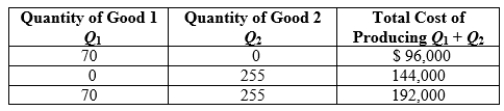

-Consider the table. What important characteristic describes this firm's production process?

Definitions:

AGI

Adjusted Gross Income is your gross income minus allowable deductions, used to determine your taxable income on your federal income tax return.

Estimated Taxes

Periodic advance payments of taxes on income that is not subject to withholding, such as earnings from self-employment, interest, dividends, and rental income.

FUTA Tax

Federal Unemployment Tax Act tax, a payroll or employment tax paid by employers to fund state workforce agencies.

Withholding Allowances

A specified number on an employee's W-4 form that reduces the amount of money withheld from their paycheck for taxes.

Q5: A consumer's bundle includes two normal goods,

Q8: Suppose that each firm in a perfectly

Q20: (Figure 3.2) If the price per bag

Q21: Suppose that the marginal utility of good

Q35: Suppose that technological breakthroughs make jet packs

Q35: The short-run production function for sea kayaks

Q53: Find marginal revenue for the firm that

Q59: The Securities and Exchange Commission appointed the

Q63: (Figure 5.3) Which of the following statements

Q81: Which of the following statements is TRUE?<br>A)