Use the following to answer question:

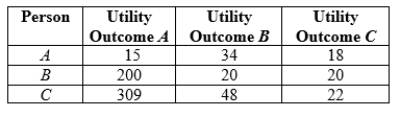

Table 15.1

-(Table 15.1) Using the Rawlsian social welfare function, rank the utility outcomes from the most to least desirable.

Definitions:

Long Hedger

A long hedger is an investor or company that enters into a hedge transaction to protect against a rise in the price of an asset in the future.

Short Hedger

A short hedger is an investor or trader who enters into contracts to sell an asset in the future to hedge against the risk of falling prices.

Treasury Bond Futures

Contractual agreements to buy or sell a specified amount of U.S. Treasury bonds at a future date and price.

Interest Rates

The percentage of an amount of money which is charged for its use per a given period, typically expressed as an annual percentage.

Q6: (Figure 10.2) Which of the following statements

Q9: What are the general equilibrium effects between

Q20: (Figure 3.2) If the price per bag

Q26: (Figure 3.21) Refer to Figure 3.21 to

Q33: Price discrimination is motivated by the firm's

Q56: (Table 13.1) The choke wage is:<br>A)40.<br>B)45.<br>C)30.<br>D) 50.

Q67: In an economy with two industries, food

Q78: (Figure 17.1) The external marginal cost is:<br>A)

Q79: (Table 10.13) The table shows consumer valuations

Q91: For a perfectly price-discriminating monopolist (ppdm), profit