Use the following to answer questions 26-28:

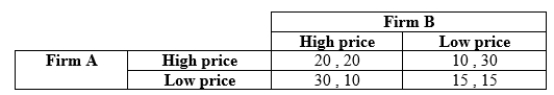

Table 12.16

-(Table 12.16) The payoffs represent profits measured in thousands of dollars. In this infinitely repeated game, Firm A and Firm B are both using grim trigger strategies; they agree to charge a high price in period 1. If Firm A has a change of heart and decides not to charge a high price in period 1, what is Firm A's expected payoff from cheating? Assume that d = 0.9.

Definitions:

Cash Flow Matching

A form of immunization, matching cash flows from a bond portfolio with those of an obligation.

Immunization

A strategy in fixed income investing that aims to make a portfolio's duration and interest rate risk match its liability obligations.

Duration Matching

An investment strategy where the durations of assets and liabilities are aligned to reduce the risk of changes in interest rates affecting the net worth.

Duration

A measure of the sensitivity of the price of a bond or other debt instrument to changes in interest rates, frequently used to assess interest rate risk.

Q7: Fairchild Garden Supply expects $600 million of

Q11: A rapid build-up of inventories normally requires

Q18: (Table 14.7) What is the expected value

Q29: On Monday, you want to start your

Q32: Consider two firms engaged in Bertrand competition

Q32: Let <span class="ql-formula" data-value="\pi"><span

Q50: (Table 12.4) Payoffs are profits in thousands

Q59: The following companies all manufacture widgets and

Q61: How might health clubs price their membership

Q92: (Figure 11.3) The graph depicts a four-firm