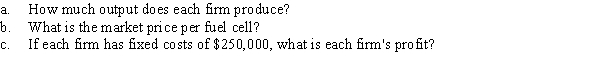

Suppose that Mystic Energy and E-Storm are the only two producers of hydrogen fuel cells. The market inverse demand curve for hydrogen fuel cells is P = 1,300 - 0.08Q, where Q is the number of fuels cells per month and P is the price per fuel cell. The marginal cost is constant at $500. Acting as a cartel, the owners of Mystic Energy and E-Storm agree to evenly split the market output.

Definitions:

Cost Advantages

Refers to the benefit a company has over its competitors in terms of lower production or operation costs.

Monopoly Power

The ability of a single firm or entity to control the market for a good or service, enabling it to influence prices and production levels.

Legal Barriers

Restrictions imposed by law that limit the entry of new firms into an industry or protect existing firms from competition.

Predatory Pricing

A pricing strategy where a company sets prices below cost to eliminate competition and establish a monopoly over time.

Q1: A convertible debenture can never sell for

Q4: A company is considering extracting natural gas

Q17: Which of the following statements about convertibles

Q27: If a leased asset has a negative

Q39: Shorter-term cash budgets--say a daily cash budget

Q43: Gotcha, the only seller of stun guns,

Q53: Consider two players in the following game.

Q78: Net working capital, defined as current assets

Q102: A line of credit can be either

Q110: Which of the following statements is CORRECT?<br>A)