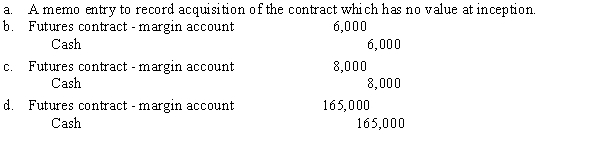

Jenson Company buys 20 contracts on the Chicago Board of Trade to receive October delivery of soybeans to a certified warehouse. Each contract is in units of 3,000 bushels at a futures price of $2.75 per bushel. The owner of the contract requires a margin account with an initial margin of $8,000, with a maintenance margin of $6,000. What entry will Jenson Company make to establish the margin account?

Definitions:

Materially Participate

The level of involvement by a taxpayer in the operations of a business that is sufficient enough to qualify for tax deductions related to active participation.

At-risk Amount

The amount of money in a particular investment that can be claimed as a deduction in the event of a loss.

Passive Activities

Economic activities in which the investor does not materially participate, and which often have different tax implications, such as rental property income.

Suspended Losses

Suspended Losses are losses from passive activities that exceed passive income, which cannot currently be deducted but can be carried forward to offset future passive income.

Q7: Which of the following would, generally, indicate

Q14: A contribution is a(n)<br>A)conditional transfer of cash.<br>B)unconditional

Q15: In a troubled debt restructuring involving only

Q22: Below are the returns for the past

Q23: Prepare the journal entries to record the

Q25: Capital improvement special assessments:<br>A)may include contributions from

Q32: In a not-for-profit organization, depreciation on capital

Q35: A corporation's accounting statement of affairs shows

Q36: On June 1, 20X5, the books of

Q59: Which of the following statements is CORRECT?<br>A)