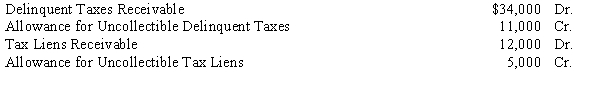

The following selected account balances for the City of Hampton on January 1, 20X8 are listed below:

Required:

Record the following transactions that occurred during 20X8:

a.Current property taxes are levied at $750,000 with a 4% allowance for uncollectible property taxes.

b.Property to which tax liens apply is sold for $6,000 and the account is closed.

c.Current property taxes are collected in the amount of $702,000.

d.Previous delinquent property taxes are converted to tax liens and the current uncollected property taxes are considered delinquent.

Definitions:

Sleepier

The state or quality of feeling or being more inclined to sleep or tiredness.

Awake

The state of being conscious, alert, and aware of one's surroundings.

Deprivation

The condition caused by a lack of necessary materials, comfort, or necessities for healthy living.

Sleepiness

A state of feeling drowsy or tired, often leading to a desire or need to sleep.

Q2: Internal Service funds:<br>A)have restricted assets.<br>B)use budgetary accounting.<br>C)must

Q13: Property taxes are considered:<br>A)imposed tax revenues.<br>B)derived tax

Q15: The purpose of an encumbrance is to:<br>A)amend

Q16: Which of the following is not required

Q27: On November 1, 20X1, a U.S. company

Q28: Consider the consolidation process for a foreign

Q32: Which of the following statements is true

Q42: Verst, Brown and Sullivan have a partnership.

Q47: When an economic transaction is denominated in

Q66: Which one of the following statements is