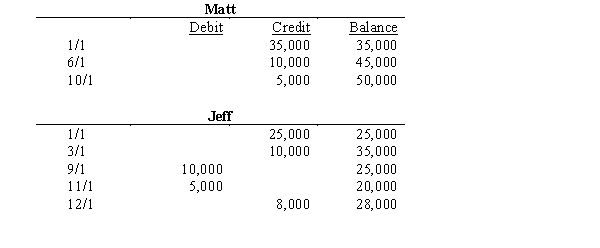

Matt and Jeff organized their partnership on 1/1/00. The following entries were made into their capital accounts during 00:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

a.Interest of 10% is allocated on weighted average capital balance and the remainder is divided equally

b.A salary of $9,000 will be allocated to Jeff; 10% interest on ending capital is allocated to the partners; remainder is divided 60/40 to Matt and Jeff, respectively

c.Salaries are allocated to Matt and Jeff in the amount of $10,000 and $15,000, respectively and the remainder is allocated in proportion to weighted average capital balances

d.A bonus of 10% of partnership profits after bonus is credited to Matt, a salary of $35,000 is allocated to Jeff, a $20,000 salary is allocated to Matt, 10% interest on weighted capital is allocated, and remainder is split equally

Definitions:

Diagnostic Consensus

The agreement among healthcare professionals on the specific diagnosis of a patient, often involving a combination of symptoms, test results, and observations.

Physical Symptoms

Manifestations of a medical condition or illness that are apparent to the patient or others, such as pain, fatigue, or dizziness.

Conversion Disorders

A type of disorder where patients experience neurological symptoms, such as paralysis or blindness, without a medical cause, often linked to psychological conflict.

Somatic Symptom Disorders

Disorders characterized by physical symptoms that cause significant distress or impairment, which are not fully explained by other medical conditions.

Q6: The management approach to segmental reporting<br>A)focuses on

Q11: Donated services are recognized as a contribution

Q17: The City of Light Falls operates a

Q18: Powell Company owns an 80% interest in

Q18: Pepin Company owns 75% of Savin Corp.

Q18: Cable and Jones are considering forming a

Q20: Differentiate by function the Accounting Statement of

Q30: Interfund transactions include all of the following

Q46: The pre-closing trial balance of the General

Q51: Which of the following best describes the