Van and Shapiro formed a partnership. As part of the formation, Van contributed equipment whose cost to her was $60,000, with accumulated depreciation for tax purposes of $36,000. The fair value of the equipment was $40,000. The partnership assumed $10,000 of Shapiro's personal debts when she was admitted into the partnership.

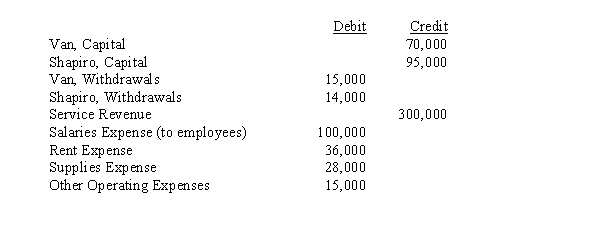

After one year of operation, the partnership had the following partial trial balance:

Partners split profits as follows:

(1)A salary of $30,000 is paid to Van.

(2)Remaining profits (or losses) are split 40% to Van, the remainder to Shapiro.

Required:

Calculate the two partners' ending capital balances.

Definitions:

Isotonic

A solution that has the same osmotic pressure as the fluids in a cell or body, resulting in no net movement of water across cell membranes.

Selectively Permeable

A property of cellular membranes that allows certain molecules or ions to pass through it by means of active or passive transport, while preventing others.

Osmosis

The passive movement of water molecules through a semi-permeable membrane from an area of low solute concentration to an area of high solute concentration.

Simple Diffusion

A process whereby molecules move from an area of higher concentration to one of lower concentration without the need for energy input.

Q9: Which of the following is not a

Q12: In the Statement of Cash Flows for

Q13: GASB Statement No. 34 requirements for the

Q22: On January 1, 20X1, a domestic firm

Q23: The Revised Uniform Partnership Agreement establishes rules

Q32: Oak, Pine, and Maple are partners with

Q54: Property taxes in the amount of $3,000,000

Q56: Rankin City established a Central Printing and

Q57: Which of the following correctly addresses how

Q67: CableTech, a US corporation, owns 100% of