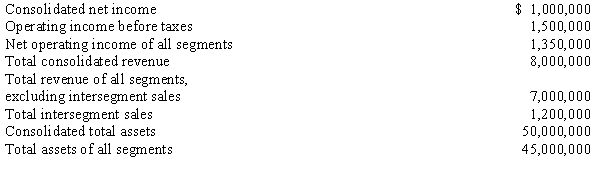

Ansfield, Inc. has several potentially reportable segments. The following financial information has been determined for the current fiscal year:  For Ansfield, Inc. to report a significant portion of its financial information as segments, its segments, in total, must represent

For Ansfield, Inc. to report a significant portion of its financial information as segments, its segments, in total, must represent

Definitions:

Discount Rate

The discount rate that adjusts future cash flows to present value, accounting for the time value of money and associated risks.

Net Present Value

A financial metric that estimates the profitability of an investment, calculated by summing the present values of expected future cash flows and subtracting the initial investment cost.

Delivery Van

A type of vehicle used for transporting goods, products, or materials from one location to another.

Working Capital

The difference between a company's current assets and current liabilities, indicating its short-term liquidity and ability to finance day-to-day operations.

Q3: A U.S. firm owns 100% of a

Q7: Under the entity theory, a partnership is<br>A)viewed

Q9: For the Statement of Cash Flows for

Q9: Company P owns 100% of the common

Q18: A United States based company that has

Q22: Which of the following best describes the

Q28: Currently, which of the following has jurisdiction

Q33: A new subsidiary is being formed. The

Q50: In which of the following circumstances surrounding

Q55: Lion Corporation, a U.S. firm, entered into