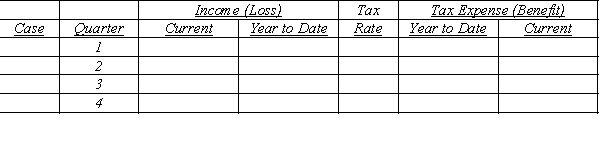

Consider the following:

Case A

Income (loss) for quarters 1 through 4 is ($50,000), $30,000, $40,000, and $40,000, respectively. Future projected income for the year is uncertain at the end of quarters 1 and 2. Annual income at the end of quarter 3 is estimated to be $20,000. No carryback benefit exists, and any future annual benefit is uncertain.

Case B

Assume the same facts as in Case A. However, at the end of quarters 1 through 3, annual income is estimated to be $40,000.

Case C

Quarterly income (loss) levels were $15,000, ($35,000), ($75,000), and $25,000. A yearly operating loss of $70,000 was anticipated throughout the year. Prior years' income of $28,000 is available for carryback. The same tax rates were relevant to the carryback period

Required:

For cases A through C, complete the schedule that follows: Assume that the statutory tax rate is 15% on the first $50,000 of income, 25% on the next $25,000, and 30% on income in excess of $75,000.

Definitions:

Probability Distribution

An equation in mathematics that calculates the likelihood of diverse outcomes in an experimental scenario.

Exponential Distribution

A probability distribution associated with the time between events in a Poisson process, characterized by a constant mean rate.

Parameter

A measurable attribute that characterizes a system or population, such as its mean or variance.

Counter Sales Narrative

A descriptive account focusing on the process and outcomes of direct sales transactions conducted over a counter.

Q27: This year, Rose Company acquired all of

Q29: Plateau Company acquires an 80% interest in

Q32: A parent company purchased all the outstanding

Q34: On January 1, 20X2, U.S.A. Inc. created

Q36: Estimated uncollectible property taxes are:<br>A)charged to expenditures

Q36: By placing a check mark in the

Q41: Contribution of a work of art to

Q43: Orbit Inc. purchased Planet Co. on January

Q49: Corriveau Industries decided to switch from an

Q60: If a city uses a General Fixed