Lion Corporation, a U.S. firm, entered into several foreign currency transactions during the year. Determine the effect of each transaction on net income for that current accounting year only. Lion has a June 30 year end.

Required:

a.On January 15, Lion sold $30,000 (Canadian) in merchandise to a Canadian firm, to be paid for on February 15 in Canadian dollars. Canadian dollars were worth $0.85 (U.S.) on January 15 and $0.82 (U.S.) on February 15.

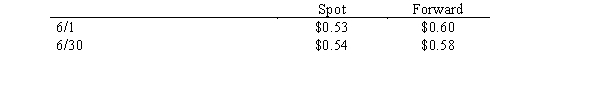

b.On June 1, Lion purchased and received a computer costing 100,000 euros from a German firm. Lion paid for the computer on August 1. On June 1, to reduce exchange risks, Lion purchased a contract to buy 100,000 marks in 60 days. Exchange rates are as follows:  Discount rate = 6%

Discount rate = 6%

c.On June 1, Lion sold merchandise to a customer for 100,000 FC and purchased an option to sell 100,000 FC in 60 days to hedge the receivable. The option sold for a premium of $6,500 and a strike price of $1.20. The value of the option 6/30 was $12,500. The spot rate on June 1 was $1.19 and $1.25 on June 30.

Definitions:

Current Yield

Current yield refers to the annual income (interest or dividends) received from an investment, expressed as a percentage of the investment's current market price.

Bond Coupon Rates

The interest rate provided by a bond each year, shown as a percentage of the bond's nominal value.

Minimum TIE

The lowest acceptable Times Interest Earned ratio, a financial metric used to determine how well a company can meet its interest payments on debt.

Restrictive Covenant

A clause in a contract that limits certain actions of the parties involved, often used in employment and real estate agreements.

Q2: A CPA donates her services to prepare

Q13: The translation (remeasurement) adjustment reported in a

Q20: Which of the following is not true

Q20: On January 1, 20X1, Patrick Company purchased

Q24: On January 1, 20X1, Paris Ltd. paid

Q28: Capital improvements which are financed by special

Q32: A subsidiary was acquired for cash in

Q44: Which of the following is not true

Q45: If bonds were initially issued at a

Q49: Following is a list of selected transactions