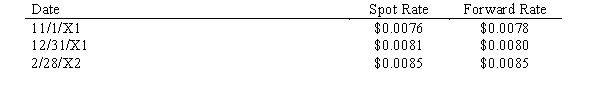

Rex Corporation, a U.S. firm with a calendar accounting year, agreed to buy a specially made truck from a Japanese firm for delivery on February 28, 20X2 with payment due on that date. On the same date the agreement was signed, November 1, 20X1, a forward contract due on February 28, 20X2, was also signed to purchase 1,000,000 yen, the contract price of the truck. Exchange rates were as follows:

Discount rate = 8%

Required:

Prepare the journal entries needed to properly reflect the purchase and forward contract through the end of the fiscal year.

Definitions:

Secularization

A process of cultural change in which a population tends toward a nonreligious worldview, ignoring or rejecting institutionalized spiritual beliefs and rituals.

Christianity

A monotheistic religion based on the life and teachings of Jesus Christ, emphasizing salvation through faith, the sacraments, and the authority of the Bible.

Nonaffiliation

The state of not being formally associated with or belonging to an organized group, religion, or political party.

Pilgrimage

A religiously inspired journey to a site believed to be metaphysically significant and typically demanding personal sacrifices from travelers.

Q9: How do you differentiate between a voluntary

Q12: What is the effect if an unconsolidated

Q16: When a parent purchases a portion of

Q27: Capital projects expected to take several years

Q40: Company A, an American company, owns Company

Q43: On January 1, 20X4, Parent Company purchased

Q43: The following transactions were made by Cape

Q49: Allen, Branden & Caylin are in the

Q65: On 6/1/X2, an American firm purchased inventory

Q68: Convertible bonds are attractive to bondholders because<br>A)they