On January 1, 20X1, Parent Company purchased 85% of the common stock, 8,500 shares, of Subsidiary Company for $317,500. On this date, Subsidiary had common stock, other paid-in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill.

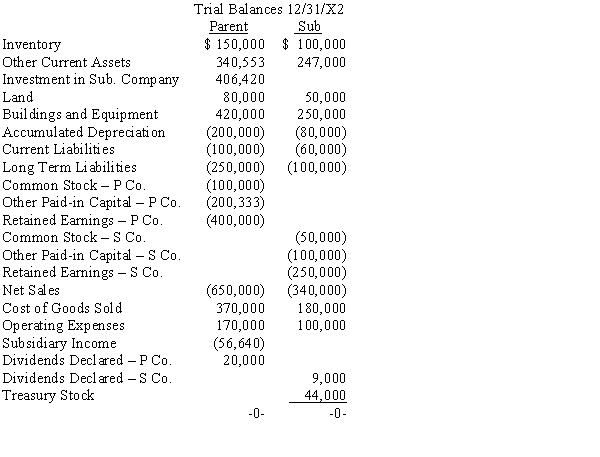

On January 1, 20X2, Subsidiary purchased, from its noncontrolling shareholders, 1,000 shares of its common stock, 10% of the stock outstanding on that date. The price paid was $44,000. The trial balances of Parent and Sub as of 12/31/X2 are given below:

Required (round all amounts to whole dollars; round percentages to one decimal: XX.X%)

a.Prepare the D&D schedule for the 1/1/X1 acquisition.

b.Prepare a schedule to determine the change in Parent's interest in Sub.

c.Prepare the journal entry the parent needed to adjust its interest in Sub. (Note that it has already been included in the parent's trial balance.)

d.Prepare, in journal form, all elimination entries necessary for the 12/31/X2 consolidation worksheet.

Definitions:

Freewheeling Exchange

An open and unstructured conversation or discussion where ideas are shared freely without judgment.

Virtual Interviews

Interviews conducted remotely using digital platforms or technology, allowing participants to connect without being physically present in the same location.

Geography

The study of Earth's landscapes, environments, and the relationships between people and their environments, including the spatial aspects of human and physical phenomena.

Phone Interview

A job interview conducted over the telephone, often used as a preliminary screening technique by employers.

Q8: On January 1, 20X1, Parent Company purchased

Q12: The entry in the General Fund to

Q16: If a bonus is traceable to the

Q27: Assume that a partnership had assets with

Q32: The effect of an operating lease on

Q33: Assume that the capital of an existing

Q35: Given the following information for the City

Q41: When a company purchases another company that

Q64: Bulldog Enterprise, a U.S. firm, agreed on

Q123: Which of the following would describe a