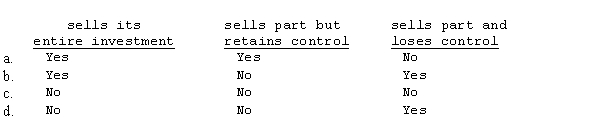

When a parent sells its subsidiary interest, a gain (loss) is recognized if the parent

Definitions:

Parent Company

A corporation that owns enough voting stock in another firm to control management and operations by influencing or electing its board of directors.

Subsidiary

A company that is completely or partially owned and controlled by another company, known as the parent company.

Legal Differences

Variations in laws and regulations across different jurisdictions.

Economic Differences

Variations in economic conditions or performance, typically among countries, regions, or sectors.

Q1: During the first quarter, a company's application

Q10: Under the equity method of accounting, items

Q31: For interim reporting, which of the following

Q37: Company P purchased an 80% interest in

Q38: Assume that the capital of an existing

Q43: On January 1, 2019, Kitchen Concepts, Inc.

Q45: Because good will is amortized over 15

Q52: Egan Company, a publicly-traded company, divides its

Q72: For each of the following account balances,

Q148: The result of using the effective interest