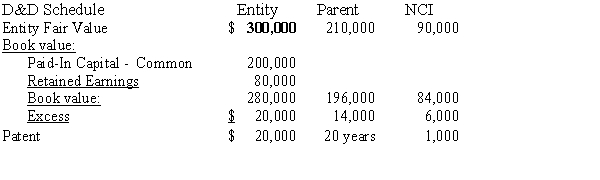

Company P Industries purchased a 70% interest in Company S on January 1, 20X1, and prepared the following determination and distribution of excess schedule:

Since the purchase, there have been the following intercompany transactions:

(1)On January 1, 20X2, Company P sold a piece of equipment with a net book value of $40,000 to Company S for $50,000. The equipment had a five-year remaining life.

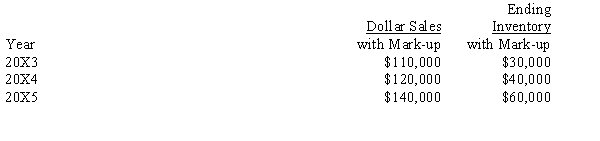

(2)Each year, starting in 20X3, Company S has sold merchandise for resale to Company P at a gross profit of 20%. A summary of transactions shows the following:

(3)On January 1, 20X5, Company P purchased Company S's 8%, $100,000 face value bonds for $98,000, which were issued at par value. The bonds have five years to maturity.

Required:

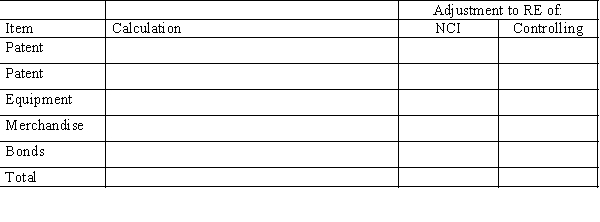

Complete the following schedule to adjust the retained earnings of the noncontrolling and controlling interest on the December 31, 20X5, worksheet for a consolidated balance sheet only. Company P uses the simple equity method to account for its investment.

Definitions:

Direct Materials

Raw materials that are directly traceable to the manufacturing of a specific product and are an integral part of the finished product.

Actual Price

The price at which a good or service is sold in the market, as opposed to its listed or theoretical price.

Standard Costing

An accounting method that uses standard costs for cost control and financial reporting.

Variable Manufacturing Overhead

Manufacturing overhead costs that fluctuate with the level of production activity.

Q5: Partners Tuba and Drum share profits and

Q11: Per the FASB, all but the following

Q13: Property taxes are considered:<br>A)imposed tax revenues.<br>B)derived tax

Q25: Differentiate between the following monetary systems: floating

Q30: Which of the following is not true

Q37: On January 1, 20X1, Parent Company purchased

Q39: Partners A and B have a profit

Q40: Company A, an American company, owns Company

Q44: Hylie, a U.S. corporation, owns 100% of

Q61: For any given contingent liability, a company