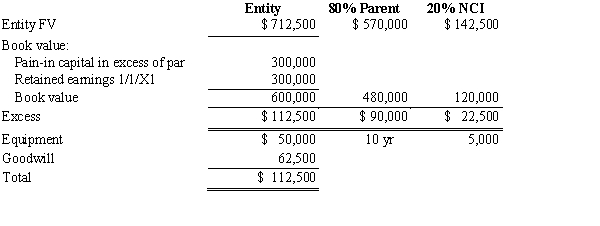

Company S has been an 80%-owned subsidiary of Company P since January 1, 20X7. The determination and distribution of excess schedule prepared at the time of purchase was as follows:

On January 2, 20X9, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000. No excess resulted from this transaction. Alpha earned $100,000 net income during 20X9 and paid $20,000 in dividends.

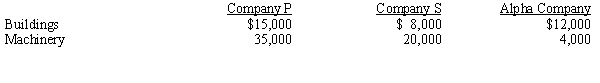

The only change in plant assets during 20X9 was that Company S sold a machine for $10,000. The machine had a cost of $60,000 and accumulated depreciation of $40,000. Depreciation expense recorded during 20X9 was as follows:

The 20X9 consolidated income was $180,000, of which the NCI was $10,000. Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

Consolidated inventory was $287,000 in 20X8 and $223,000 in 20X9; consolidated current liabilities were $246,000 in 20X8 and $216,700 in 20X9. Cash increased by $203,700.

Required:

Using the indirect method and the information provided, prepare the 20X9 consolidated statement of cash flows for Company P. and its subsidiary, Company S.

Definitions:

Bargaining Obligation

The legal responsibility of employers and unions to negotiate in good faith over terms and conditions of employment, including wages, hours, and working conditions.

Impasse

A situation in negotiations where no agreement can be reached because the parties involved cannot find a solution to their differences.

Recognition Strike

A strike action undertaken by workers to compel an employer to recognize their union as the official bargaining agent.

Bargaining Agent

An individual or organization designated to represent and negotiate on behalf of a group, typically employees in discussions with their employer.

Q2: While acquisitions are often friendly, there are

Q3: Patten Company purchased an 80% interest in

Q4: For each of the following independent cases,

Q8: Soap Company issued $200,000 of 8%, 5-year

Q9: RWB Corporation, a U. S. based company,

Q24: On January 1, 20X1, Paris Ltd. paid

Q29: The ALPHA, BETA, AND DELTA partnership has

Q43: Company P purchased an 80% interest in

Q43: The following transactions were made by Cape

Q45: Which of the following would be least