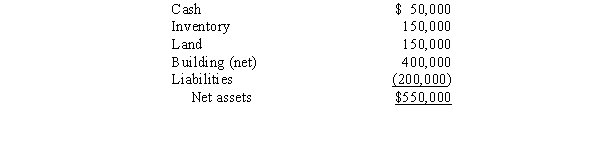

Ponti Company purchased the net assets of the Sorri Company for $800,000. The book value of the net assets of Sorri Company were as follows on the acquisition date:  The market values were as follows: Inventory, $160,000; Land, $170,000; Building, $450,000. The excess purchase price is allocated to goodwill. On the consolidated statement of cash flows, what is the amount that will appear as cash applied to investing as a result of this purchase?

The market values were as follows: Inventory, $160,000; Land, $170,000; Building, $450,000. The excess purchase price is allocated to goodwill. On the consolidated statement of cash flows, what is the amount that will appear as cash applied to investing as a result of this purchase?

Definitions:

Manufacturing Overhead

Every cost related to the manufacturing process that isn't direct labor or direct materials expenses.

Conversion Costs

The costs incurred to convert raw materials into finished products, including direct labor and manufacturing overhead but not direct materials.

Direct Labor

The wages paid to workers who are directly involved in the production of goods or services.

Accounts Receivable Clerks

Employees responsible for managing and tracking the money owed to a business by its debtors.

Q1: On January 1, 20X4, Parent Company purchased

Q2: Company P has consistently sold merchandise for

Q10: Goodwill results when:<br>A)a controlling interest is acquired.<br>B)the

Q11: If in the consolidation process the investment

Q15: Which of the following is not an

Q21: Maxwell is trying to decide whether to

Q29: Refer to Kids R Kids Company. The

Q29: Lease terms can be considered to be

Q31: The characteristic of a partnership where a

Q107: The use of borrowed capital to produce