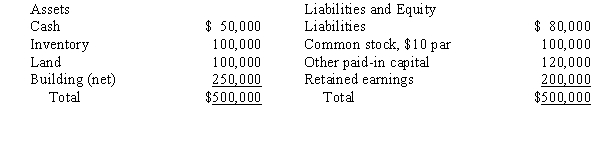

Company P acquired 60% of the outstanding common stock of Company S by issuing common stock with a market value of $420,000 on January 1, 20X3. The balance sheet of Company S was as follows on the acquisition date:  The market values were as follows: Inventory, $130,000; Land, $150,000; Building, $400,000. The inventory was sold during 20X3, the building has a 10-year life, and any excess purchase price is attributed to goodwill. What adjustment is needed to consolidated net income to arrive at cash flow-operations for 20X4, under the indirect method, as a result of amortization of excesses from the purchase?

The market values were as follows: Inventory, $130,000; Land, $150,000; Building, $400,000. The inventory was sold during 20X3, the building has a 10-year life, and any excess purchase price is attributed to goodwill. What adjustment is needed to consolidated net income to arrive at cash flow-operations for 20X4, under the indirect method, as a result of amortization of excesses from the purchase?

Definitions:

Attachment

An emotional bond that forms between individuals, typically between a child and caregiver, which influences the child's development and future relationships.

Intersexed

A term used to describe individuals born with physical sex characteristics that do not fit typical binary notions of male or female bodies.

Transsexual

A term describing a person whose gender identity differs from the sex they were assigned at birth, often undergoing medical procedures to transition.

Equal

Having the same value, quantity, or measure as another entity or condition.

Q2: A forward exchange contract is being transacted

Q2: Which of the following is not a

Q7: Which of the following is not true

Q13: A contingent liability of an acquiree<br>A)refers to

Q23: Prossart Company owned 70% of the outstanding

Q31: The characteristic of a partnership where a

Q41: A U.S. Corp. purchased a computer from

Q47: Which of the following suggests that the

Q125: A significant disadvantage of financing with debt

Q180: Liquidity relates to a company's ability to