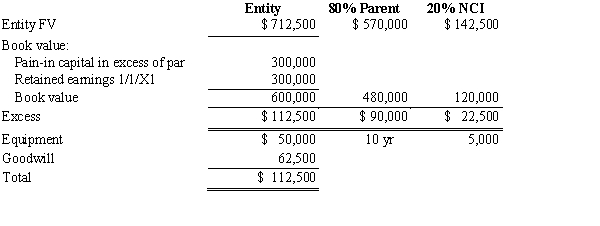

Company S has been an 80%-owned subsidiary of Company P since January 1, 20X7. The determination and distribution of excess schedule prepared at the time of purchase was as follows:

On January 2, 20X9, Company P issued $120,000 of 8% bonds at face value to help finance the purchase of 25% of the outstanding common stock of Alpha Company for $200,000. No excess resulted from this transaction. Alpha earned $100,000 net income during 20X9 and paid $20,000 in dividends.

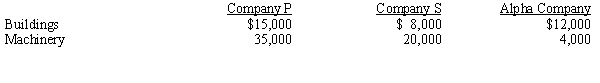

The only change in plant assets during 20X9 was that Company S sold a machine for $10,000. The machine had a cost of $60,000 and accumulated depreciation of $40,000. Depreciation expense recorded during 20X9 was as follows:

The 20X9 consolidated income was $180,000, of which the NCI was $10,000. Company P paid dividends of $12,000, and Company S paid dividends of $10,000.

Consolidated inventory was $287,000 in 20X8 and $223,000 in 20X9; consolidated current liabilities were $246,000 in 20X8 and $216,700 in 20X9. Cash increased by $203,700.

Required:

Using the indirect method and the information provided, prepare the 20X9 consolidated statement of cash flows for Company P. and its subsidiary, Company S.

Definitions:

Mathematics

Mathematics is the abstract study of numbers, quantity, structure, space, and change, used as a tool in a wide range of disciplines.

Stockholders

Individuals or entities that own shares in a corporation, giving them a stake in the company's performance and potential profits.

Annual Shareholder Meetings

A yearly gathering where company executives report to shareholders on the firm's performance and strategy.

Receive Interest

Earning income on an investment, such as a bond or savings account, based on the interest rate over time.

Q3: On January 1, 20X1, Paris Ltd. paid

Q4: A government may avoid charging depreciation on

Q11: Pepper Company owned 60,000 of Salt Company's

Q16: When determining the fair values of assets

Q26: If the city expends more during the

Q36: A company's management expects to incur future

Q38: Which of the following procedures would be

Q41: Company P purchased an 75% interest in

Q55: Lion Corporation, a U.S. firm, entered into

Q90: A corporation issued $150,000 of 10-year bonds