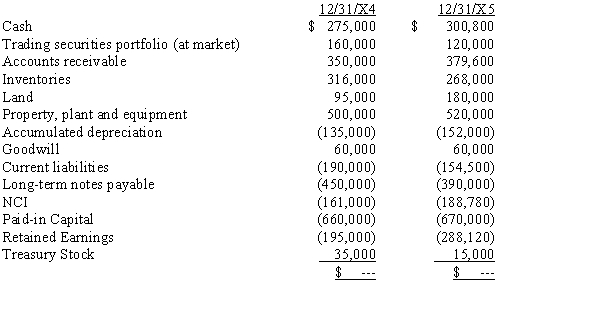

The following comparative consolidated trial balances apply to Perella Company and its subsidiary Sherwood Company (80% control):

The following is additional information for 20X5:

a)No trading securities were sold nor were any investments added to the portfolio.

b)Land was acquired by issuing a $40,000 note and giving cash for the balance.

c)Equipment (cost $50,000; accumulated depreciation $40,000) was sold for $3,000

d)Dividends declared and paid: Perella 50,000; Sherwood $40,000.

e)Consolidated net income amounted to $178,900.

Required:

Prepare the consolidated statement of cash flows for the year ended December 31, 20X5, for Perella and its subsidiary.

Definitions:

Remembering

The cognitive process of retrieving past experiences or information.

Prototype

An original model or initial version of something from which other forms are copied or developed.

Penguin

A flightless seabird native to the Southern Hemisphere, particularly known for its distinctive black and white plumage.

Goose

A waterfowl of the family Anatidae, known for its long neck, webbed feet, and often migratory behavior.

Q7: Company P purchased a 80% interest in

Q22: On January 1, 20X1, a domestic firm

Q23: Income taxes are considered:<br>A)imposed tax revenues.<br>B)derived tax

Q23: On January 1, 20X1, Paul, Inc. acquired

Q28: On January 1, 20X1, Parent Company acquired

Q41: Taylor and Tanner formed a partnership. Taylor

Q51: With regard to major customers, which of

Q109: The two promises made by a bond

Q116: Under the effective interest method, the cash

Q128: Occurs when a bond is issued for