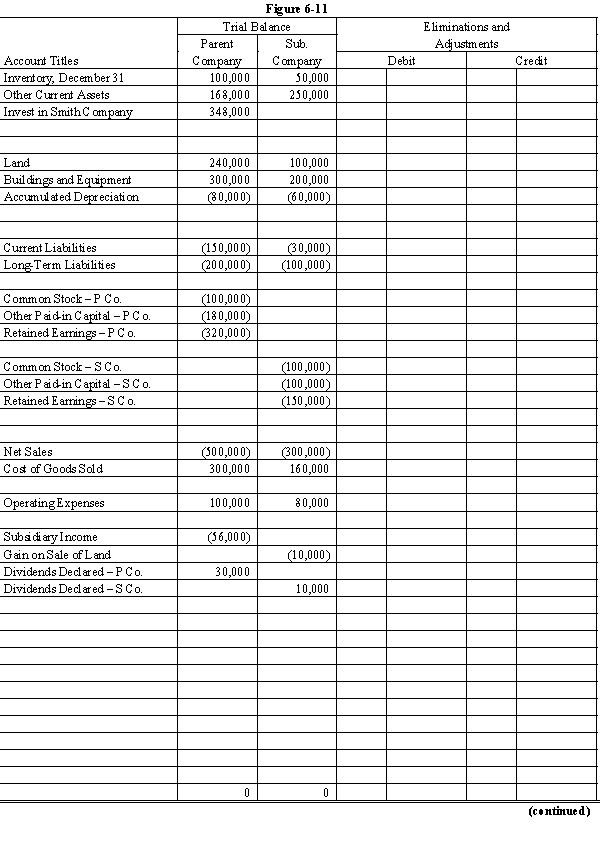

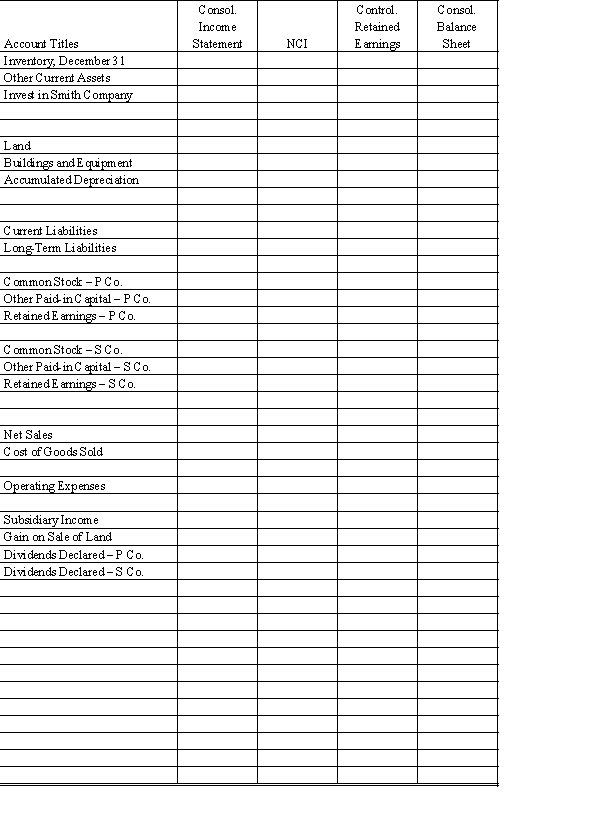

On January 1, 20X8, Paul Company purchased 80% of the common stock of Smith Company for $300,000. On this date Smith had total owners' equity of $350,000. Any excess of cost over book value is attributed to a patent, to be amortized over 10 years.

During 20X8, Paul has accounted for its investment in Smith using the simple equity method.

During 20X8, Paul sold merchandise to Smith for $50,000, of which $10,000 is held by Smith on December 31, 20X8. Paul's gross profit on sales is 40%.

During 20X8, Smith sold some land to Paul at a gain of $10,000. Paul still holds the land at year end.

Paul and Smith qualify as an affiliated group for tax purposes and thus will file a consolidated tax return. Assume a 30% corporate income tax rate.

Required:

Complete the Figure 6-11 worksheet for consolidated financial statements for the year ended December 31, 20X8.

Definitions:

Equilibrium Price

The market price at which the quantity of a good supplied equals the quantity demanded, leading to a stable market situation.

Government Intervention

Actions taken by a government to affect the economy, which can include regulations, subsidies, tariffs, and more.

Equilibrium Price

The price at which the quantity of a good or service demanded equals the quantity supplied, resulting in no shortage or surplus.

Equilibrium Quantity

The quantity of goods or services sold and bought at the equilibrium price, where market supply equals market demand.

Q8: Long-term partners, Pop, Ping, and Pam have

Q12: Jolly is a partner in the HoHoHo

Q18: Powell Company owns an 80% interest in

Q18: Assuming that the functional currency of a

Q25: Soap Company issued $200,000 of 8%, 5-year

Q35: An investor prepares a single set of

Q56: Which of the following statements regarding amortization

Q63: The following transactions were made by the

Q122: The contract rate is also called the

Q141: Which of the following statements regarding accounts