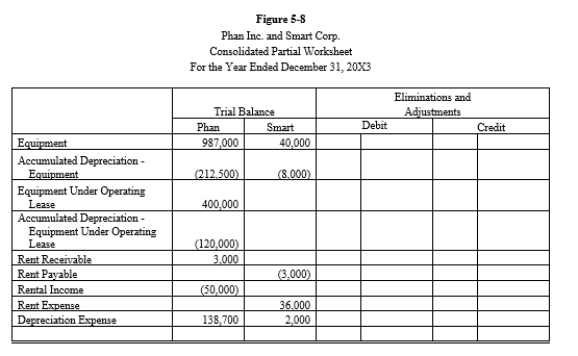

Smart Corporation is a 90%-owned subsidiary of Phan Inc. On January 2, 20X1, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease. The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-8 partial worksheet for December 31, 20X3. Key and explain all eliminations and adjustments.

Definitions:

Government-delivered Services

Services provided by the government to its citizens, such as healthcare, education, and public safety.

Equipment-delivered Services

Services provided through the use of specialized equipment or machinery, often in sectors like healthcare, construction, or manufacturing.

Nonprofit-delivered Services

Services provided by organizations that operate without the primary goal of making a profit, often focused on social, educational, or charitable activities.

Fee-delivered Services

Services provided to consumers for a specific fee, often customized or tailored to individual needs.

Q10: On January 1, 20X1, Parent Company purchased

Q12: Company P had 300,000 shares of common

Q17: On January 1, 20X1, Parent Company purchased

Q22: The cash purchase of a controlling interest

Q29: Rex Corporation, a U.S. firm with a

Q31: For interim reporting, which of the following

Q34: The partnership of Able, Bower, and Cramer

Q77: The payment of Accounts Payable results in

Q122: A cookie company includes one premium coupon

Q142: A long-term leased asset would appear on