On January 1, 20X1 Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the simple equity method.

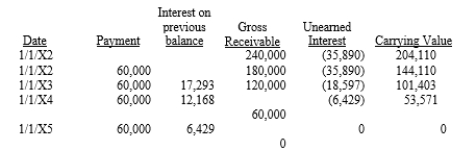

On January 1, 20X2, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies. The lease amortization schedule is presented below:

Required:

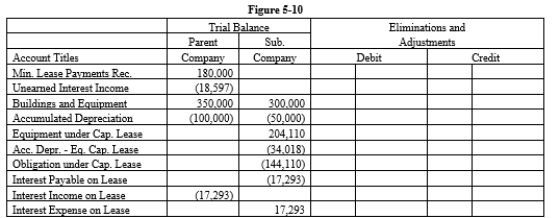

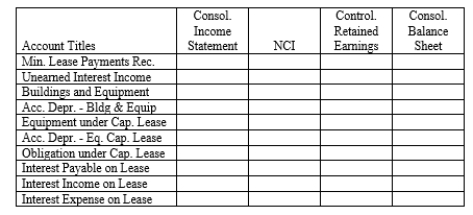

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-10 partial worksheet as of December 31, 20X2. Key and explain all eliminations and adjustments.

Definitions:

Social Frameworks

Structures that provide guidelines for behavior and interactions within social groups, including norms, roles, and institutions.

Group Decisions

The process by which two or more individuals agree upon a decision within a group setting, often requiring negotiation and compromise.

Consequential Theories

Ethical theories that determine the rightness or wrongness of actions based on their outcomes or results.

Rule-based Theories

Philosophical theories that emphasize the importance of following structured, predefined rules or guidelines to determine moral conduct or decision-making processes.

Q14: Diller owns 80% of Lake Company common

Q34: For a hedge on an exposed position,

Q43: Orbit Inc. purchased Planet Co. on January

Q45: On January 1, 20X5, Brown Inc. acquired

Q47: Company S is a 100%-owned subsidiary of

Q52: Exchange gains and losses resulting from translating

Q62: Refer to Korn Business Solutions. Write the

Q68: The City of Franklin has adopted the

Q145: A probable loss from a lawsuit that

Q163: Refer to Gainesville Truck Center. Assuming December