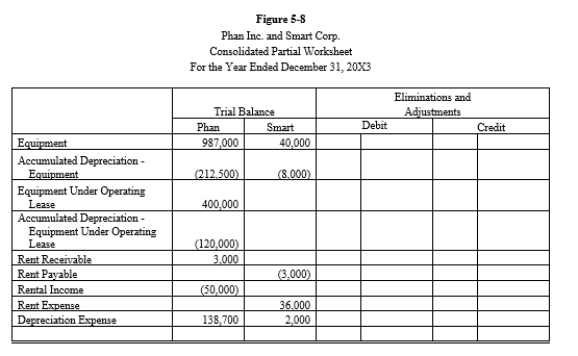

Smart Corporation is a 90%-owned subsidiary of Phan Inc. On January 2, 20X1, Smart agreed to lease $400,000 of construction equipment from Phan for $3,000 a month on an operating lease. The equipment has a 10-year life and is being depreciated using the straight-line method.

Required:

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-8 partial worksheet for December 31, 20X3. Key and explain all eliminations and adjustments.

Definitions:

Generation X

A demographic cohort following the Baby Boomers, typically defined as individuals born from the early-to-mid 1960s to the early 1980s.

Postwar

Refers to the period immediately following the end of a war, often marked by significant sociopolitical and economic changes.

Regional Culture

The influence of the area within a country in which people live.

Pepsi

A global beverage and food company known for its flagship product, Pepsi-Cola, a carbonated soft drink.

Q10: Sharp Company owns a Japanese subsidiary, whose

Q11: Pease Corporation owns 100% of Sade Corporation

Q13: In determining if two operating segments may

Q18: The method of accounting for subsidiaries that

Q18: Hetzer and Whalen partnership is insolvent and

Q32: A parent company purchased all the outstanding

Q49: A contractual agreement to borrow and repay

Q52: Egan Company, a publicly-traded company, divides its

Q62: Assume a company has a current ratio

Q116: Under the effective interest method, the cash