On January 1, 20X1 Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent accounts for the Investment in Subsidiary using the simple equity method.

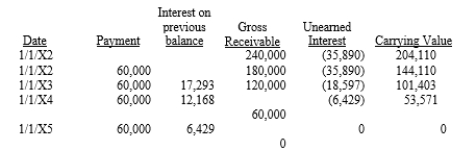

On January 1, 20X2, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies. The lease amortization schedule is presented below:

Required:

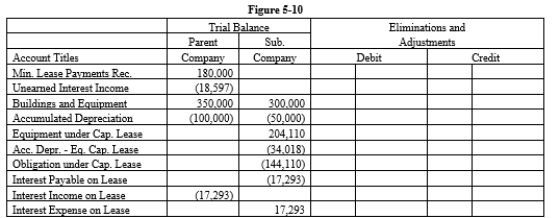

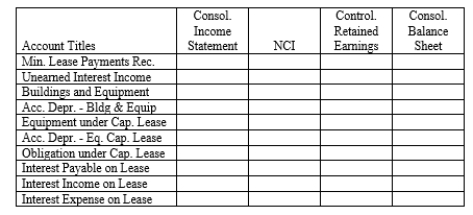

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-10 partial worksheet as of December 31, 20X2. Key and explain all eliminations and adjustments.

Definitions:

Causes

The reasons or factors that lead to certain effects, outcomes, or states of being.

Scientifically Innovative

Describes novel approaches, tools, or findings that significantly advance understanding or practices within the scientific field.

Crucial Experiment

An experiment that is critically important in testing and potentially proving or disproving a hypothesis or theory.

Hypothesis

A hypothesis is a proposed explanation for a phenomenon, serving as a starting point for further investigation to be tested through experimentation or observation.

Q9: Assume that the capital of an existing

Q10: A subsidiary has outstanding $100,000 of 8%

Q29: There are some liabilities, such as income

Q37: On January 1, 20X1, Parent Company purchased

Q39: On January 2, 2019, Kampai Sushi Bar

Q41: When a new partner buys an ownership

Q87: Giff Services Company experienced some difficulties with

Q125: Refer to the partial balance sheet presented

Q141: The debt-to-equity ratio is defined as total

Q158: Refer to Korn Business Solutions. Does the