On January 1, 20X1, Parent Company acquired 90% of the common stock of Subsidiary Company for $360,000. On this date, Subsidiary had common stock, other paid in capital, and retained earnings of $50,000, $100,000, and $200,000 respectively. Any excess of cost over book value is due to goodwill. Parent uses the simple equity method to account for its investment in subsidiary.

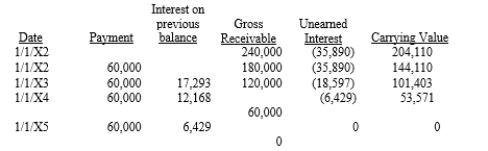

On January 1, 20X2, Parent purchased equipment for $204,110 and immediately leased the equipment to Subsidiary on a 4-year lease. The minimum lease payments of $60,000 are to be made annually on January 1, beginning immediately, for a total of 4 payments. The implicit interest rate is 12%. The lease provides for an automatic transfer of title at the end of 4 years. The estimated useful life of the equipment is 6 years. The lease has been capitalized by both companies. A lease amortization schedule, applicable to either company, is presented below:

Required:

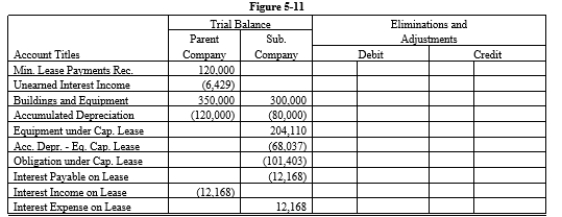

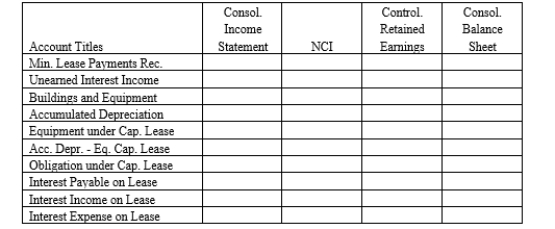

Prepare the eliminations and adjustments required by the intercompany lease on the Figure 5-11 partial worksheet as of December 31, 20X3. Key and explain all eliminations and adjustments.

Definitions:

Economic Environments

The combination of economic factors that influence the operations of businesses and markets, including inflation, unemployment, economic policies, and market demand.

Ethical Advocate

An individual or entity that actively promotes and defends ethical behavior and principles.

Critical Questioner

A practice or skill focused on engaging in questioning and critique to understand or analyze issues deeply.

Top-Management

The highest level of management in an organization, including positions such as CEO, CFO, and other senior executives, responsible for strategic decisions and overall direction.

Q19: Callie is admitted to the Adams &

Q20: On January 1, 20X1, Parent Company purchased

Q25: Differentiate between the following monetary systems: floating

Q34: Goodwill is an intangible asset. There are

Q35: An investor prepares a single set of

Q35: Bonds sell at a premium when the<br>A)issuing

Q41: List the two primary objectives of translating

Q51: What is the impact on the accounting

Q60: Rent owed to the lessor under a

Q77: The payment of Accounts Payable results in