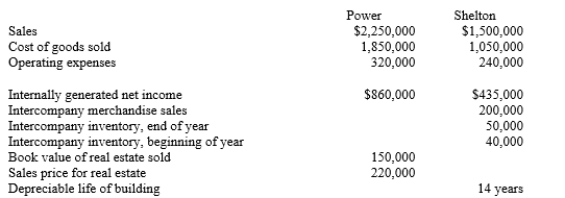

Power Company owns an 70% controlling interest in the Shelton Company. Shelton regularly sells merchandise to Power, which then sells to outside parties. The gross profit on these sales is the same as sales to outside parties. On January 1, 20X4, Power sold land and a building to Shelton. Twenty percent of the price of the real estate was allocated to land and the remaining amount to structures. Additional information for the companies for 20X4 is summarized as follows:

Prepare income distribution schedules for 20X4 for Power and Shelton as they would be prepared to distribute income to the noncontrolling and controlling interests in support of consolidated worksheets.

Definitions:

Stock Market

The network of exchanges, brokers, and investors that trade in stocks.

Network of Investors

A group or community of individuals and organizations interested in investing in various opportunities, sharing risks, and exchanging knowledge.

Brokers

Individuals or firms that act as intermediaries between buyers and sellers in financial markets to facilitate transactions.

Raising Capital

The process by which a firm obtains money or funds to finance its operations, expansion, or investments.

Q1: An advantage of financing with debt rather

Q7: Company P purchased a 30% interest in

Q9: On January 1, 20X1, Company P purchased

Q9: Company S is a 100%-owned subsidiary of

Q13: Company P owns a 30% interest in

Q25: A owns 80% of B and 20%

Q43: A company has a note payable that

Q141: Which of the following statements regarding accounts

Q154: The times interest earned ratio divides _

Q158: State unemployment taxes<br>A)Account payable<br>B)Note payable<br>C)Wages payable<br>D)Interest payable<br>E)Sales