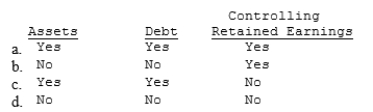

On January 1, 20X1, a parent loaned $30,000 to its 100%-owned subsidiary on a 5-year, 8% note. The note requires a principal payment at the end of each year of $6,000 plus payment of interest accrued to date. The following accounts require adjustment in the consolidation process:

Definitions:

Subjective Measure

An assessment method based on personal opinions, interpretations, or feelings rather than objective criteria or metrics.

Performance

The execution of an action or task in consideration of its efficiency, effectiveness, and quality.

Net Profits

The amount of money left after all expenses, taxes, and costs have been subtracted from total revenue.

Focal Leader

A primary leader who is the central point of guidance and decision-making within a group or organization.

Q3: Paro Company purchased 80% of the voting

Q23: Consolidation might not be appropriate even when

Q29: Which of the following is not true

Q34: Stidham Company is a large international company

Q35: An obligation that involves an existing condition

Q37: When the functional currency is the foreign

Q41: Federal unemployment taxes<br>A)Account payable<br>B)Note payable<br>C)Wages payable<br>D)Interest payable<br>E)Sales

Q43: On January 1, 20X4, Parent Company purchased

Q152: A percentage of the loan amount that

Q178: Refer to General Lighting. When the company