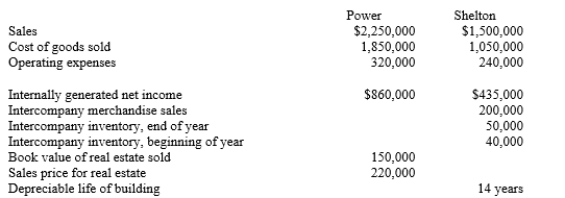

Power Company owns an 70% controlling interest in the Shelton Company. Shelton regularly sells merchandise to Power, which then sells to outside parties. The gross profit on these sales is the same as sales to outside parties. On January 1, 20X4, Power sold land and a building to Shelton. Twenty percent of the price of the real estate was allocated to land and the remaining amount to structures. Additional information for the companies for 20X4 is summarized as follows:

Prepare income distribution schedules for 20X4 for Power and Shelton as they would be prepared to distribute income to the noncontrolling and controlling interests in support of consolidated worksheets.

Definitions:

Planning Budget

A financial plan that estimates income and expenditure for a future period.

Cost Drivers

Factors that cause the cost of an activity to increase or decrease, influencing the total cost.

Planning Budget

A budget prepared for a specific level of activity that may be adjusted for various activity levels.

Vocational School

An educational institution that provides practical and skills-based training aimed at preparing students for specific trades, professions, or careers.

Q18: Cammy Company had inventory at the end

Q31: Smith, Thompson and Nickels have a partnership.

Q37: Page Company purchased an 80% interest in

Q44: When a company uses past experience to

Q53: A company pays wages of $12,500 at

Q56: In a hedge of a forecasted transaction,

Q66: Medicare taxes<br>A)Account payable<br>B)Note payable<br>C)Wages payable<br>D)Interest payable<br>E)Sales taxes

Q115: Refer to Gainesville Truck Center. Which of

Q143: The current ratio is calculated as follows:

Q180: Liquidity relates to a company's ability to