On January 1, 20X1, Parent Company acquired 80% of the common stock of Subsidiary Company for $560,000. On this date Subsidiary had total owners' equity of $540,000, including retained earnings of $240,000. During 20X1, Subsidiary had net income of $60,000 and paid no dividends.

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

During 20X1 and 20X2, Parent has appropriately accounted for its investment in Subsidiary using the cost method.

On January 1, 20X2, Parent held merchandise acquired from Subsidiary for $10,000. During 20X2, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 20X2. Subsidiary's usual gross profit on affiliated sales is 40%.

On December 31, 20X2, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

On January 1, 20X2, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000. The sales price was $40,000. Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

Required:

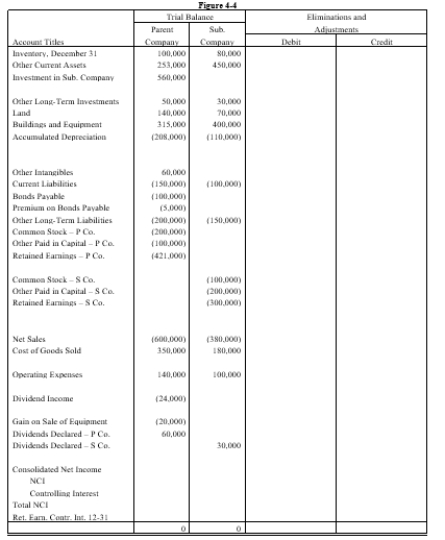

Complete the Figure 4-4 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Definitions:

Work in Process

Inventory that includes the materials, labor, and overhead costs for products that are in the production process but not yet complete.

Equivalent Units

A measure used in cost accounting to express the amount of work done on incomplete units in terms of complete units.

First-in

Commonly part of the term "First-in, First-out (FIFO)", a method used in inventory management where the oldest stock is sold first.

Labor

Work performed by humans that is used in the production of goods and services.

Q1: While performing a goodwill impairment test, the

Q29: A corporation made up of an automobile

Q33: If the yield rate of interest is

Q34: In the year a parent sells its

Q37: Company P purchased an 80% interest in

Q72: (Cash + Marketable Securities) / Current Liabilities<br>A)Current

Q73: Complete the following table: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2014/.jpg" alt="Complete

Q90: A corporation issued $150,000 of 10-year bonds

Q139: The current portion of long-term debt would

Q169: An example of a current liability is