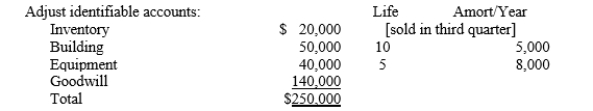

The determination and distribution schedule for the consolidation of Petoskey (80% interest) and Sable reads in part:

Prepare the elimination entries to distribute and amortize the excess purchase cost on

a. 1/1/X1, the date of acquisition

b. 12/31/X1, the end of the first year following the acquisition

c. 12/31/X3, the end of the third year following the acquisition.

Definitions:

Share Split

A business move where a company splits its current shares into additional ones to increase the shares' marketability.

Share Price

The current market price of a single share of a company's stock.

Reverse Stock Split

A corporate action in which a company decreases the number of its outstanding shares to increase the share price without changing the company's market capitalization.

Market Value

The ongoing cost at which a service or asset is being exchanged in the market.

Q1: Company P uses the sophisticated equity method

Q3: Maxwell is trying to decide whether to

Q5: On January 1, 20X3, Company P purchased

Q5: Pepper Company owns 60,000 of Salt Company's

Q9: Company P owns 100% of the common

Q22: When evaluating a company's solvency, an investor's

Q29: When a subsidiary owns shares of the

Q34: On the balance sheet, the cumulative amount

Q35: A French subsidiary of a U.S. firm

Q42: Consolidated Basic Earnings Per Share (BEPS) is