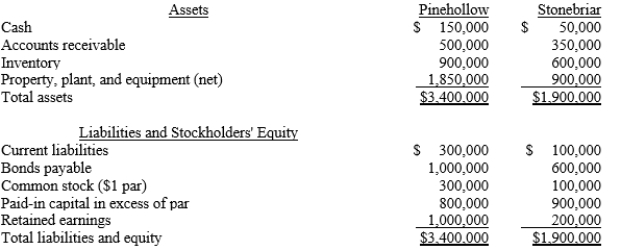

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:  The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. The journal entry to record the purchase of Stonebriar would include a

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. The journal entry to record the purchase of Stonebriar would include a

Definitions:

Monopolistic Competition

A market structure characterized by many firms selling products that are similar but not identical, allowing for some differentiation and price control.

Long-Run Economic Profits

The sustained extra income a firm generates when all inputs are variable, indicating the firm's long-term competitive advantage.

Monopolistic Competition

Monopolistic competition is a market structure where many companies sell products that are similar but not identical, allowing for product differentiation and some degree of market power.

Marginal Benefit

The incremental advantage received by using one more unit of a good or service.

Q2: When Palm, Inc. acquired its 100% investment

Q4: All but the following are required disclosures

Q9: Which of the following is not a

Q12: What is the effect if an unconsolidated

Q21: The sale of inventory items by a

Q28: The following events took place in Morgan

Q137: Refer to Fabian Woodworks. If the company

Q141: The debt-to-equity ratio is defined as total

Q168: A(n) _ usually guarantees the repair or

Q172: The proceeds from advance ticket sales for