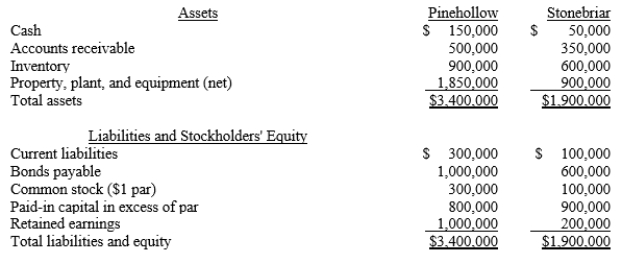

Pinehollow acquired 70% of the outstanding stock of Stonebriar by issuing 70,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:  The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of the noncontrolling interest that will be included in the consolidated balance sheet immediately after the acquisition?

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. What is the amount of the noncontrolling interest that will be included in the consolidated balance sheet immediately after the acquisition?

Definitions:

Q6: On January 1, 20X1, Rapid Corporation purchased

Q17: On January 1, 20X1, Paul, Inc. acquired

Q29: Which of the following is not true

Q38: During 20X3, a parent company billed its

Q39: A company has cash of $800, current

Q40: On January 1, 20X1, a U.S. firm

Q44: Company S is a 100%-owned subsidiary of

Q131: A company issued $500,000 of bonds for

Q154: Grand Strand Power & Light provides utilities

Q176: _ refers to the ability of a