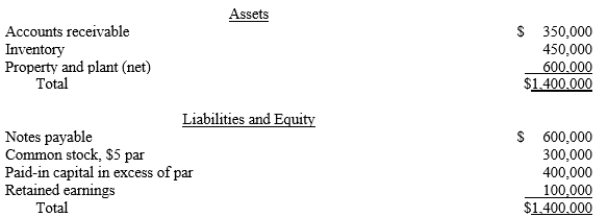

Supernova Company had the following summarized balance sheet on December 31 of the current year:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20 per share, for 100% of the common stock of Supernova Company. Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

Required:

a.What journal entries will Redstar Corporation record for the investment in Supernova and issuance of stock?

b.Prepare a supporting value analysis and determination and distribution of excess schedule

c.Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Definitions:

Lump Sum

A one-time payment made at a specific moment, rather than multiple smaller payments spread over time.

Savings Options

Various financial vehicles available for setting aside money, such as savings accounts, certificates of deposit, and money market funds, with the aim of earning a return.

Compounded Weekly

Refers to interest earned or paid that is calculated on a weekly basis, with each week's interest added to the principal amount.

Emergency Fund

A reserve of money set aside to cover unexpected expenses or financial emergencies.

Q2: When Palm, Inc. acquired its 100% investment

Q5: Partners Tuba and Drum share profits and

Q20: On January 1, 2019, a company issued

Q21: Which of the following statements is true

Q22: When a parent purchases a portion of

Q30: Foreign firms operating in highly inflationary economies

Q34: In the year a parent sells its

Q36: In periods of inflation, debt financing is

Q68: Convertible bonds are attractive to bondholders because<br>A)they

Q80: Agreement whereby the legal owner of the