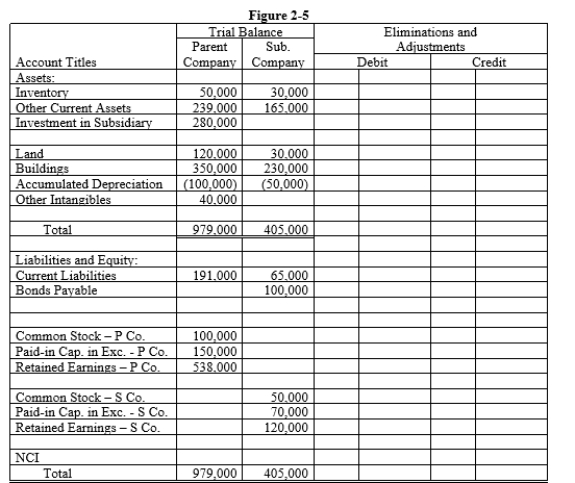

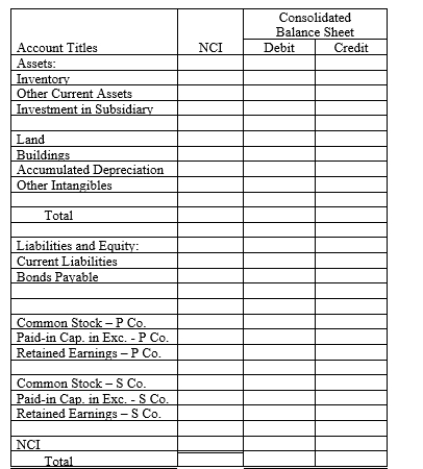

On January 1, 20X1, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000. On this date, Subsidiary had total owners' equity of $240,000.

On January 1, 20X1, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment. The fair value of land is $50,000. The fair value of building and equipment is $200,000. The book value of the land is $30,000. The book value of the building and equipment is $180,000.

Required:

a.Using the information above and on the separate worksheet, complete a value analysis schedule

b.Complete schedule for determination and distribution of the excess of cost over book value.

c.Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 20X1.

Definitions:

Maintenance Agreement

A contract between two parties in which one agrees to maintain an asset owned by the other party, in return for a fee.

Implicit Lease Rate

The interest rate assumed in the calculation of lease payments, not always explicitly stated in the lease agreement.

Discount Rate

The discount rate is the interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows.

Present Value Interest Factors

A factor used to calculate the present value of a future amount of money or stream of payments, considering a specific interest rate and time period.

Q1: The forward rate in a forward contract<br>A)is

Q2: Pepper Company owned 60,000 of Salt Company's

Q4: All but the following are required disclosures

Q20: On June 30, 20X1, Naeder Corporation purchased

Q23: A(n) _ occurs when the management of

Q25: Parr Company purchased 100% of the voting

Q37: On January 1, 20X1, Parent Company purchased

Q51: What is the impact on the accounting

Q102: Refer to the partial balance sheet presented

Q149: Which of the following would appear on