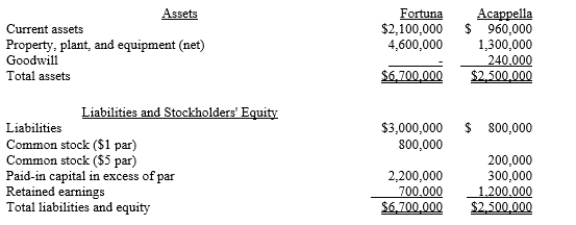

Fortuna Company issued 70,000 shares of $1 par stock, with a fair value of $20 per share, for 80% of the outstanding shares of Acappella Company. The firms had the following separate balance sheets prior to the acquisition:

Book values equal fair values for the assets and liabilities of Acappella Company, except for the property, plant, and equipment, which has a fair value of $1,600,000.

Required:

a.Prepare a value analysis schedule

b.Prepare a determination and distribution of excess schedule.

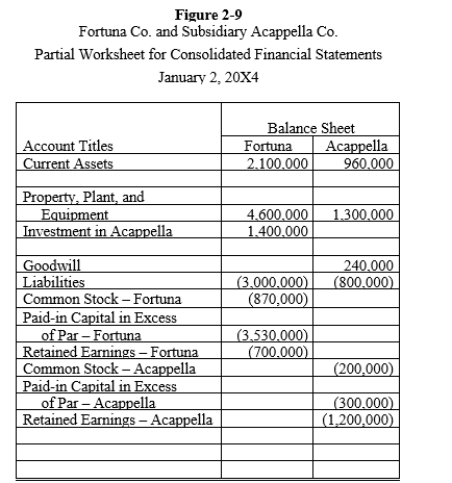

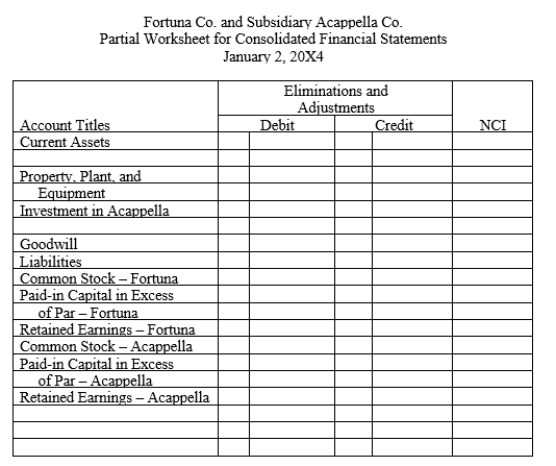

c.Provide all eliminations on the partial balance sheet worksheet provided in Figure 2-9 and complete the noncontrolling interest column.

Definitions:

Confidence Interval

A set of values obtained from sample data, which is expected to encompass the value of an unspecified population parameter.

Margin of Error

A statistic expressing the amount of random sampling error in a survey's results, representing the range within which the true population parameter is likely to lie with a certain degree of confidence.

Variance

A statistical measure that tells us how much a set of numbers is spread out; it's the average of the squared differences from the Mean.

Confidence Interval

A range of values, determined from sample statistics, that is likely to contain the value of an unknown population parameter.

Q18: Cammy Company had inventory at the end

Q29: Refer to Kids R Kids Company. The

Q30: Foreign firms operating in highly inflationary economies

Q31: For interim reporting, which of the following

Q36: Pilatte Company acquired a 90% interest in

Q41: A U.S. Corp. purchased a computer from

Q46: Acceptable current ratios vary from industry to

Q70: In a company's disclosure of foreign currency

Q120: Refer to Gainesville Truck Center. Which of

Q153: Which of the following costs related to