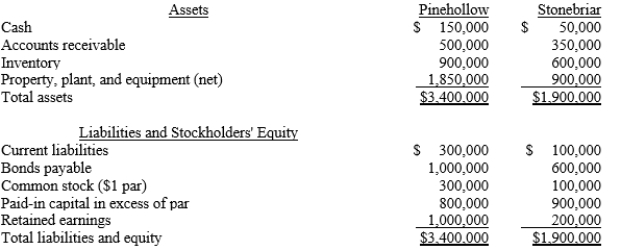

Pinehollow acquired all of the outstanding stock of Stonebriar by issuing 100,000 shares of its $1 par value stock. The shares have a fair value of $15 per share. Pinehollow also paid $25,000 in direct acquisition costs. Prior to the transaction, the companies have the following balance sheets:  The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. The journal entry to record the purchase of Stonebriar would include a

The fair values of Stonebriar's inventory and plant, property and equipment are $700,000 and $1,000,000, respectively. The journal entry to record the purchase of Stonebriar would include a

Definitions:

Breast Development

The natural physiological process of growth and change that female breasts undergo during puberty and over the life span.

Emotional-Sexual Relationships

Connections between individuals that involve both emotional intimacy and sexual attraction or activity.

Homosexuals

Individuals who are romantically or sexually attracted to people of their same sex.

Reproductive Capability

The ability of an organism to produce offspring, thereby ensuring the continuation of its species.

Q1: Turner, Ike, and Gibson formed a partnership

Q4: Polk issues common stock to acquire all

Q15: The operating cash flow ratio is computed

Q22: The method of accounting for subsidiaries where

Q37: Elimination procedures for intercompany bonds purchased from

Q38: State income taxes<br>A)Account payable<br>B)Note payable<br>C)Wages payable<br>D)Interest payable<br>E)Sales

Q63: A company expects to receive a substantial

Q79: Which of the following would appear only

Q138: If a company's bonds are callable,<br>a.the bondholder

Q156: When will bonds sell at a discount?<br>A)The