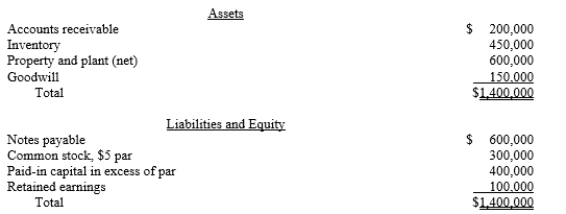

Supernova Company had the following summarized balance sheet on December 31 of the current year:

The fair value of the inventory and property and plant is $600,000 and $850,000, respectively.

Assume that Redstar Corporation exchanges 75,000 of its $3 par value shares of common stock, when the fair price is $20 per share, for 100% of the common stock of Supernova Company. Redstar incurred acquisition costs of $5,000 and stock issuance costs of $5,000.

Required:

a.What journal entries will Redstar Corporation record for the investment in Supernova and issuance of stock?

b.Prepare a supporting value analysis and determination and distribution of excess schedule

c.Prepare Redstar's elimination and adjustment entry for the acquisition of Supernova.

Definitions:

Reserve Requirement

The minimum amount of deposits that a bank must hold in reserve and not lend out, which is set by the central bank as a means to control the money supply.

Open-Market Sales

Transactions where central banks sell securities in the open market to control the supply of money.

Treasury Securities

Debt instruments issued by the government to finance its expenditures, including bills, notes, and bonds.

Money Supply

The sum total of economic assets in monetary form at a specific time.

Q7: If a US. parent loans funds on

Q13: The following accounts were noted in reviewing

Q16: A parent company owns a 90% interest

Q21: When there is an unguaranteed residual value

Q28: Which of the following intercompany transactions would

Q46: When the acquisition of a subsidiary occurs

Q60: Rent owed to the lessor under a

Q63: On January 2, 2019, Kangaroo Convenience Stores

Q145: Knox Jewelers issued $1,000,000 of 8% interest

Q160: Federal excise taxes payable is not a