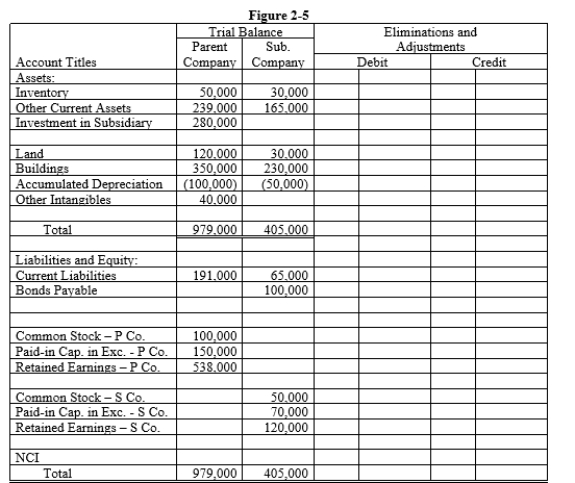

On January 1, 20X1, Parent Company purchased 100% of the common stock of Subsidiary Company for $280,000. On this date, Subsidiary had total owners' equity of $240,000.

On January 1, 20X1, the excess of cost over book value is due to a $15,000 undervaluation of inventory, to a $5,000 overvaluation of Bonds Payable, and to an undervaluation of land, building and equipment. The fair value of land is $50,000. The fair value of building and equipment is $200,000. The book value of the land is $30,000. The book value of the building and equipment is $180,000.

Required:

a.Using the information above and on the separate worksheet, complete a value analysis schedule

b.Complete schedule for determination and distribution of the excess of cost over book value.

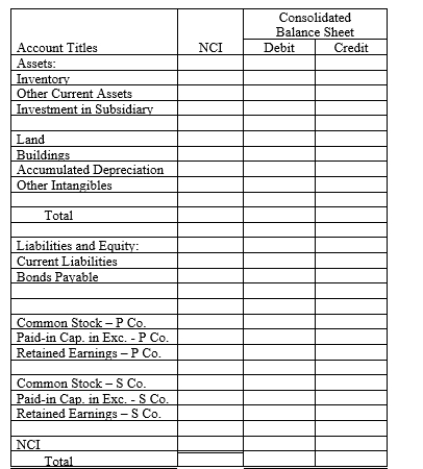

c.Complete the Figure 2-5 worksheet for a consolidated balance sheet as of January 1, 20X1.

Definitions:

Windows 7

An operating system developed by Microsoft as part of the Windows NT family, released for manufacturing on July 22, 2009.

Windows 8

An operating system by Microsoft, characterized by its metro design language, featuring a new start screen with a grid of dynamically updating tiles to represent applications.

PowerPoint Presentation

A collection of slides created using Microsoft PowerPoint software, used typically for educational or business presentations.

Automatically Synced

Automatically synced refers to the process where data is synchronized across devices or platforms without manual intervention, ensuring consistency of information.

Q3: The usual impetus for transactions that create

Q7: Which of the following is not true

Q19: Which of the following situations is viewed

Q19: Which of the following is true of

Q22: The cash purchase of a controlling interest

Q35: Soap Company issued $200,000 of 8%, 5-year

Q39: East Company, a highly diversified corporation, reports

Q62: A transaction involving foreign currency will most

Q111: _ bonds may be retired by the

Q177: Taxes levied by state and local governments<br>A)Accrued