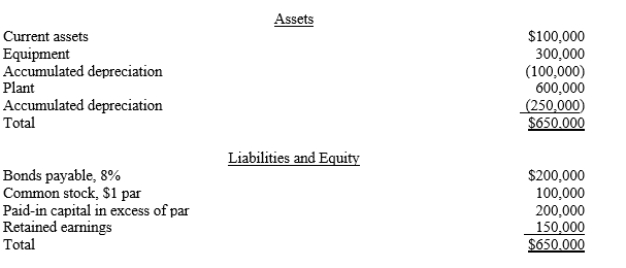

The Chan Corporation purchased the net assets (existing liabilities were assumed) of the Don Company for $900,000 cash. The balance sheet for the Don Company on the date of acquisition showed the following:

Required:

The equipment has a fair value of $300,000, and the plant assets have a fair value of $500,000. Assume that the Chan Corporation has an effective tax rate of 40%. Prepare the entry to record the purchase of the Don Company for each of the following separate cases with specific added information:

a.The sale is a nontaxable exchange to the seller that limits the buyer to depreciation and amortization on only book value for tax purposes.

b.The bonds have a current fair value of $190,000. The transaction is a taxable exchange.

c.There are $100,000 of prior-year losses that can be used to claim a tax refund. The transaction is a taxable exchange.

d.There are $150,000 of past losses that can be carried forward to future years to offset taxes that will be due. The transaction is a taxable exchange.

Definitions:

Q1: On January 1, 20X1, Poplar Company acquired

Q2: Company P has consistently sold merchandise for

Q15: On January 1, July 1, and December

Q19: Which of the following costs of a

Q33: On April 1, 2019, Guyton Sails accepted

Q40: On January 1, 20X1, a U.S. firm

Q114: Geiss Motorsports sold 50 motorbikes for $1,000

Q117: This debt, evidenced by a formal agreement

Q134: An example of a current liability is

Q158: The _ depreciation method is the GAAP