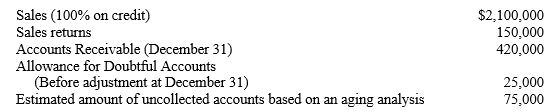

Data for the year ended December 31 are presented below.Sales (100% on credit)

-Refer to A&B Foods. If the company estimates its bad debts at 4% of net credit sales, what amount will be reported as bad debt expense?

Definitions:

Gross Profit

Gross profit refers to the difference between revenue and the cost of goods sold before administrative, overhead, and other expenses.

Receivables Turnover Ratio

A financial metric that measures a company's effectiveness in extending credit and collecting debts, calculated by dividing net credit sales by the average accounts receivable.

Net Sales

The amount of sales revenue remaining after deducting returns, allowances for damaged or missing goods, and discounts.

Accounts Receivable

Funds that customers owe to a business for products or services that have been received but remain unpaid.

Q20: _ costs are expenditures incurred in the

Q24: When making lending decisions, lenders generally are

Q50: When should a shipping company recognize revenue

Q70: Rent had been incurred, but not yet

Q74: Calmar Corporation sold merchandise to a customer

Q147: An accounting transaction may impact only one

Q157: Xu, Inc. reported the following information for

Q165: Refer to the information provided for Eli

Q184: Cash was collected from customers for services

Q189: Which of the following documents is used