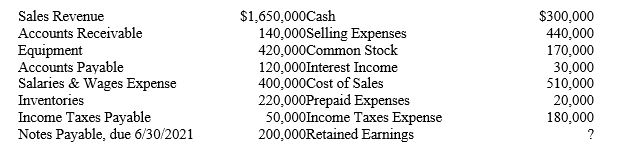

The accountant prepared the following list of account balances from the company's records for the year ended December 31, 2019.Sales Revenue

-Determine the following amounts for Backus Tractor Sales.

A)Current Assets at the end of 2019

Total Assets at the end of 2019

B)Current Liabilities at the end of 2019

C)What parties have a claim on the company's assets? Explain your answer in the terms of the accounting equation.

Definitions:

Pure Selfishness

an ethical or philosophical perspective prioritizing self-interest or personal gain above the welfare of others.

Charitable Contributions

Money or goods given to organizations for the purpose of helping people or supporting societal, educational, religious, or other charitable activities.

Favorable Tax Treatment

Tax policies or provisions that reduce the tax burden on certain activities, income types, or investments to encourage their growth or stability.

Marginal Adjustment

Small, incremental changes made to a plan, system, or calculation in response to changes in circumstances or new information.

Q13: The following unadjusted amounts were taken from

Q70: Rent had been incurred, but not yet

Q118: An abbreviated version of an account, which

Q121: A(n) _ revenue results when cash is

Q137: Refer to B-There Transportation. Is the change

Q149: Allows companies to artificially divide their operations

Q153: Issued long term mortgage to acquire land

Q158: The difference between accrual-based revenue and accrual-based

Q181: Dividend payout ratio<br>A)Debt-to-equity ratio<br>B)Dividend payout ratio<br>C)Dividend yield

Q194: Sum of the dividend payout and stock