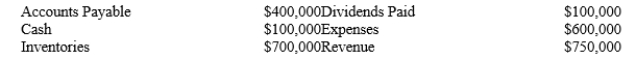

The following amounts were taken from the accounting records at December 31, 2019:  ?

?

A)Calculate Total Assets.

B)Calculate Net Income for 2019.

C)Calculate Total Stockholders' Equity at the end of 2019.

D)Calculate Total Stockholders' Equity at the beginning of 2019 assuming there were no stock transactions during the year.

Definitions:

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life, reflecting the decrease in value over time.

Accounts Receivable

Accounts receivable refers to the money owed to a business by its customers for goods or services delivered on credit but not yet paid for.

Net Income

A metric indicating the amount of earnings left after the subtraction of all expenses, including taxes and operating expenses, reflecting a company's profitability.

Inventory

Items held for sale in the ordinary course of business, as well as supplies and raw materials intended for use in producing goods for sale.

Q8: An insurance company received advance payments from

Q22: Refer to Recovery Solutions, Inc. Evaluate the

Q58: Under the indirect method, the first line

Q69: The various rules and conventions that have

Q84: _ is the capacity of information to

Q85: Which of the following represents one of

Q126: What information is provided in an annual

Q149: When using the indirect method to determine

Q172: What is the revenue recognition principle?

Q173: Unearned revenue<br>A)Assets<br>B)Liabilities<br>C)Revenues<br>D)Expenses<br>E)Stockholders' Equity